swap in forex means

A swap rate is the rate of the fixed leg of a swap as determined by its particular market. NZD 175 USD 05 125.

How To Trade Forex Steps To Trading Forex

What is swap in Forex.

. So you will either be paid out. It is flexible and has informational advantages for traders. Forex swap is not actually a physical swap.

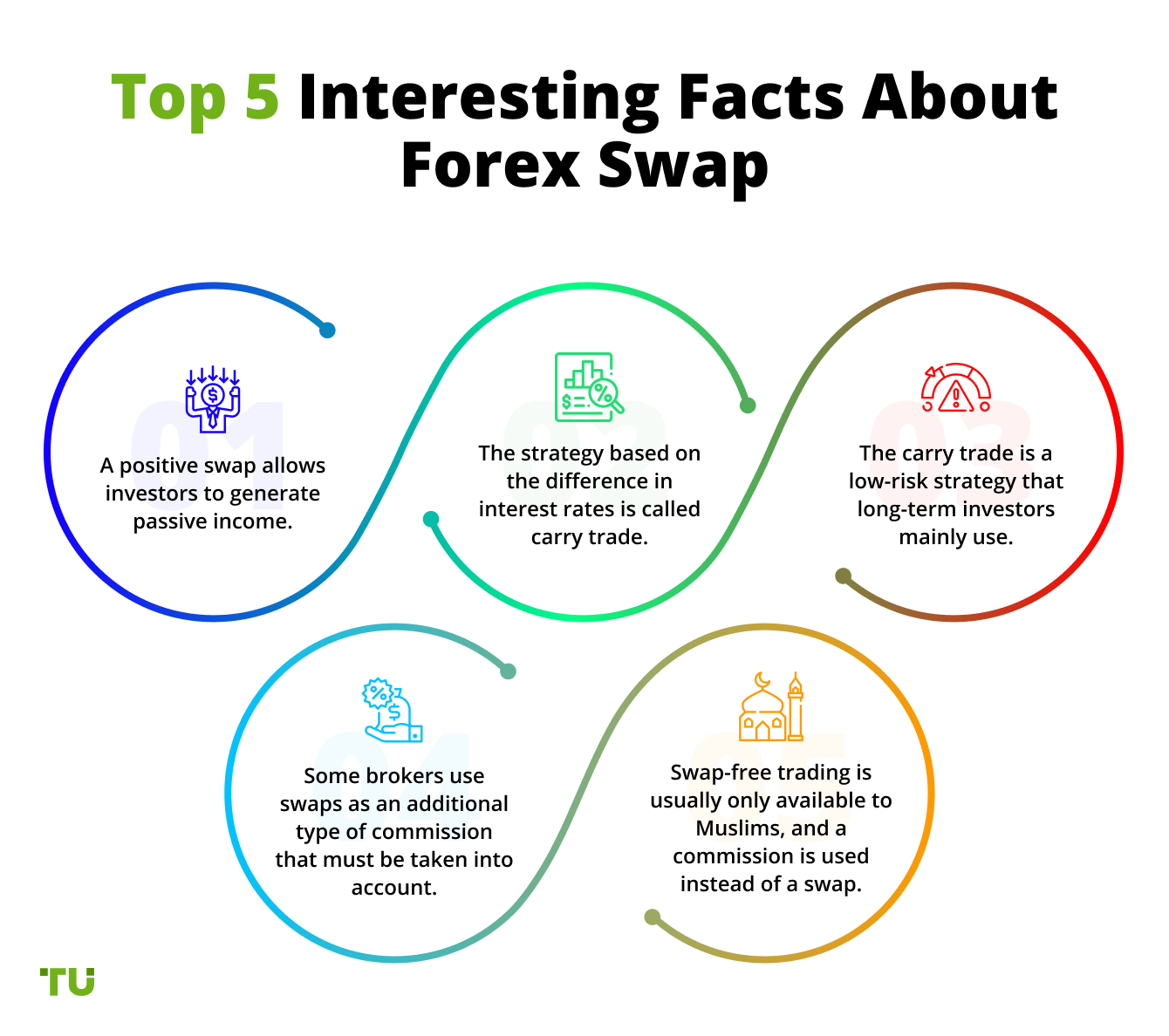

Swap is a cheaper technique to earn money from forex trading. A currency swap is calculated on the basis of a differential between interest rates. The agreement consists of swapping principal and interest payments on a loan made.

The central banks of each country determine the key interest rate. Lets take an example. Swap-free accounts have the same additional trading requirements as Standard.

When your long position on EURAUD is rolled over to the next day 307 will be debited from your trading account. Online Forex broker. Ad Investing doesnt have to be complicated.

A currency swap sometimes referred to as a cross-currency swap involves the exchange of interest and sometimes of principal in one currency for the same in another currency. Long swaps these are used when you have an open position that you have bought gone long and kept overnight. Hire Independent Professionals To Join Your Business.

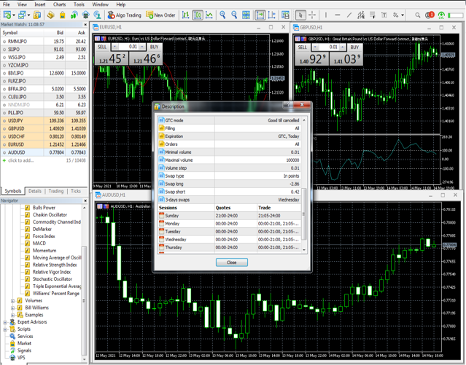

The Swap-free account is designed for traders who use trading systems that dont allow them to get swaps due to their religious views or for customers who arent allowed to receive swaps. ETRADE helps make it simple. SWAP Contract InterestRateDifference Commission 100 Рrice DaysPerYear SWAP 100000 075 025 100 11200 365 307 USD.

It means that you will have to pay the fee for holding a position overnight. It does not have any premium and even reduces the transaction cost of the trader. In the case you borrowed the currency with a lower interest rate comparing to the currency in what you invested you would receive this fee on your account every.

Find Top Talent Now. A variety of market participants such as financial institutions and their customers multinational companies institutional investors who want to hedge their foreign exchange positions and speculators use foreign exchange swaps. Instead a swap in Forex is an interest fee which needs to either be paid in or will be charged added to your account when the days trading comes to an end.

So a swap in forex trading is the interest that you pay or receive for keeping an open trade overnight. We hope that you have enjoyed the above article explaining the swap in. A swap in forex refers to the interest that you either earn or pay for a trade that you keep open overnight.

This differential should be divided by 365 days thus we get a percentage value which has to be paid. 15 you pay -1. Ad Get Fresh Ideas Brand New Talent.

Swap Free is an opti. A foreign currency swap is an agreement to exchange currency between two foreign parties. This is the rate at which the central bank lends to other banks.

Swap long used for keeping long positions open overnight and Swap short used for keeping short positions open overnight. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. When trading on margin you receive interest on your long positions while paying interest on short positions.

Swap is an interest fee that is either paid or charged to you at the end of each trading day. There are two types of swaps. The net interest difference is known as the carry and traders seeking to profit from this are known as carry traders.

Swap hedges the risk of the market in long-term trading. In an interest rate swap it is the fixed interest rate. Post a Job Free and Get Qualified Proposals Within 24 Hours.

A swap spread is the difference between the negotiated and fixed rate of a swap. An FX swap or currency swap involves two simultaneous currency purchases one on the spot rate and the other through a forward contract. They are expressed in pips per lot and vary depending on the financial instrument.

Foreign exchange swap is the difference in the interest rates of the banks issuing the two currencies which is credited to or charged from the account when the trading position is kept overnight. A forex swap could be either positive or negative. Foreign Currency Swap.

Wide Range Of Investment Choices Including Options Futures and Forex. Short swaps these are used when you have an open position that you have shorted gone short and kept overnight. The spread is determined by characteristics of market supply and creditor worthiness.

It controls Islamic accounts the other sort of account with the same name.

![]()

This Guide Will Tell You Everything You Wanted To Know About Swap In Forex How It Is Calculated How You Can Bene Forex Financial Instrument Forex Trading

What Is Swap And How Does It Fit Into Forex And Cfd Trading Libertex Com

Complex Derivative Linked To Constant Maturity Swap

Trading Psychology On Instagram Stay Humble Tradingpsychology Tradingdiscipline Tradingmotivation Tradingquotes Daytrader Daytradinglifestyle Forextrading

Supply And Demand Trading A Forex Trader S Guide

What Is A Swap Fxtm Learn Forex In 60 Seconds Youtube

Swap Definition Forexpedia By Babypips Com

Focus On A Single Currency Exchange To Build Up Your Forex Skills Concentrating Forex Marketcap

/dotdash_Final_Why_the_Forex_Market_Is_Open_24_Hours_a_Day_Sep_2020-01-d2b1c5295a0b4d7a8df8eb057505efb3.jpg)

Why Is The Forex Market Open 24 Hours A Day

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Forex_Risk_Management_Jul_2020-01-44f4b0616f4547ea8cef266cde06cf01.jpg)

Understanding Forex Risk Management

Harmonic And Classic Patterns Page 58

An Introduction To Foreign Exchange Swaps Forex Training Group